Healthcare IT Investments, Top Healthcare IT Companies Revenue & Market Position, Digital Health, Spending Trends and Strategic Transformations

Healthcare providers are investing heavily in digital transformation, with the adoption of electronic health records (EHRs), telehealth platforms, and AI-driven analytics. According to data provided by Precedence Research, the global healthcare IT market is expected to reach significant milestones by 2035. This growth is driven by strategic investments in digital health, including AI, telehealth, and clinical decision-making platforms, improving care delivery and operational efficiency.

Ottawa, Feb. 06, 2026 (GLOBE NEWSWIRE) -- According to Precedence Research, healthcare IT investments have surged over the last few years, reflecting an increasing focus on digital transformation. From record funding for digital health technologies to expanding IT budgets for healthcare providers, the sector is evolving rapidly. However, recent funding dips reflect macroeconomic conditions rather than a lack of interest in digital healthcare solutions. This article explores the key investment trends, financial figures, and technological innovations transforming healthcare delivery globally.

Invest in Our Premium Strategic Solution: https://www.precedenceresearch.com/request-consultation/52

Key Investment Trends in Healthcare IT

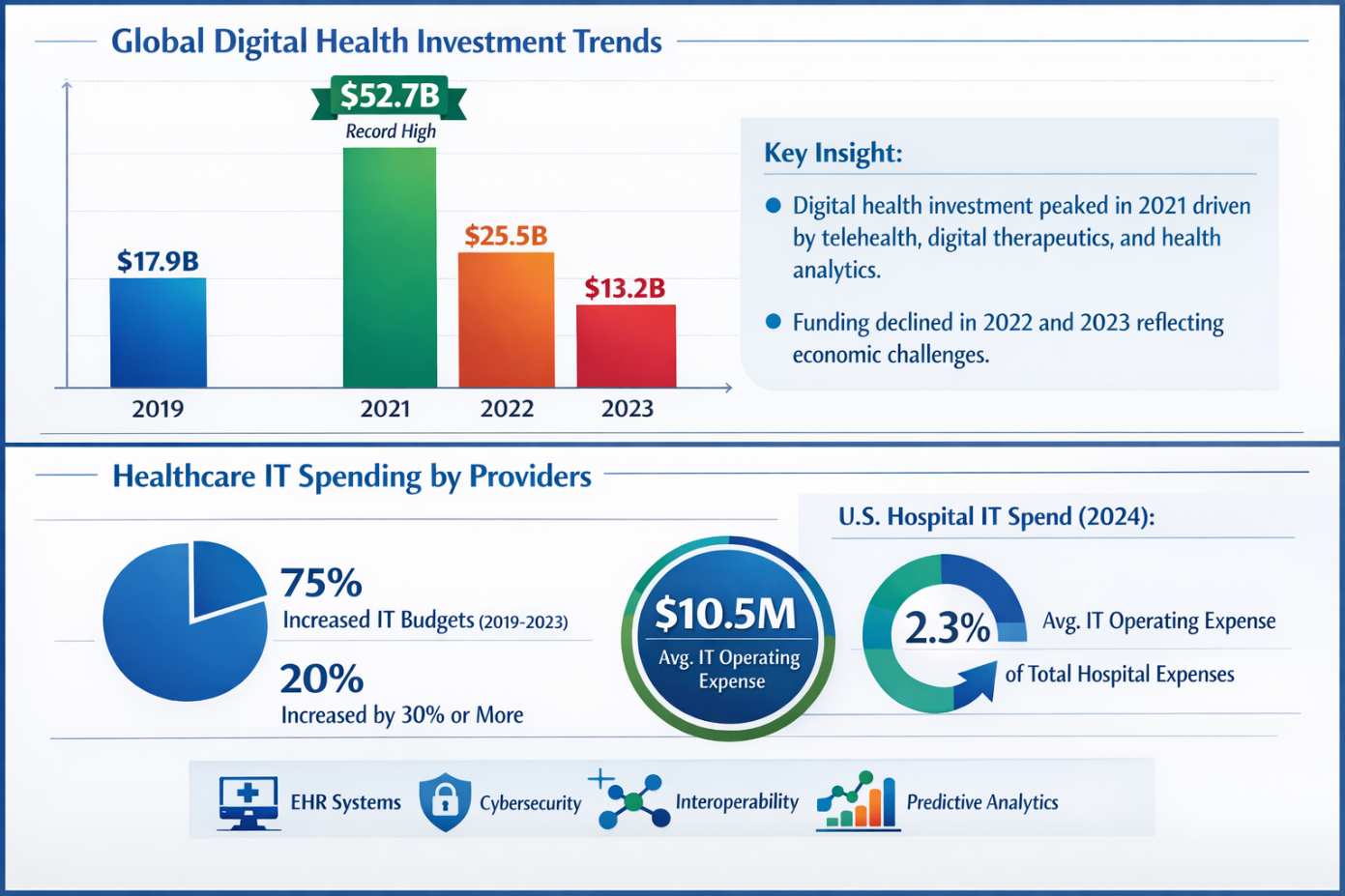

The digital health landscape has witnessed fluctuating funding trends, with a notable increase in 2021 followed by a decline in 2022 and 2023, reflecting broader economic conditions.

1. Global Digital Health Investment Trends

- 2019: $17.9B

- 2021: $52.7B (record high)

- 2022: $25.5B

- 2023: $13.2B

Key Insight:

- Digital health investment reached a peak in 2021, driven by strategic interest in telehealth, digital therapeutics, and health analytics. However, the decline in funding over the next two years mirrors broader economic challenges, signaling a natural market correction rather than a lack of innovation or interest.

2. Healthcare IT Spending by Providers

A significant portion of healthcare budgets has been allocated to IT infrastructure, reflecting the shift toward digital transformation in the industry.

-

75% of healthcare providers increased their IT and digital budgets from 2019 to 2023, with 20% of them seeing increases of more than 30%.

U.S. Hospital IT Spend (2024):

- Average hospital IT operating expense: $10.5M

- Percentage of total hospital expenses: 2.3%

Key Insight:

- Healthcare organizations are prioritizing investments in Electronic Health Records (EHRs), interoperability, cybersecurity, and predictive analytics, with a strong focus on addressing workforce shortages and improving care delivery.

Top Healthcare IT Companies Revenue & Market Position

| Company | Revenue / Scale / Public Metric | Healthcare IT Focus | Market Position |

| Epic Systems Corporation | Serves 280M+ patient records worldwide | EHR & clinical systems | Largest EHR vendor (42–44% share) in U.S. hospitals. |

| Oracle Health (Cerner) | ~$3.3 B annual revenue (IT segment) | EHR & health tech | 2nd largest EHR vendor (25% share). |

| MEDITECH | Not publicly disclosed revenue | EHR systems | 3rd largest hospital EHR vendor (12–13% share). |

| TruBridge | Not disclosed | EHR & RCM | 6.3% hospital EHR share. |

| Veradigm (Allscripts) | Not publicly posted standalone revenue | EHR, practice management | 3.6% share in hospital EHR. |

| athenahealth | Not publicly disclosed (part of Veritas/others) | EHR & RCM | Smaller share but strong ambulatory presence. |

| eClinicalWorks | Not public revenue | EHR for practices | Leader in ambulatory share (11.9%). |

| NextGen Healthcare | Not publicly available revenue | EHR & clinical systems | 4.2% ambulatory share. |

| McKesson Corp. | ~$251 B total (2024)* | Healthcare IT services & distribution | One of the largest healthcare wholesalers & IT services. |

| GE Healthcare (IT segment) | Part of General Electric; $17+ B healthcare segment | Imaging, analytics, data | Strong presence in clinical IT and imaging IT. |

| Philips | €16.8 B (2024 healthcare revenue) includes IT/analytics | Clinical IT & imaging platforms | Major interoperability and clinical platform vendor. |

| Siemens Healthineers | €21.2 B (2024 healthcare revenue) incl. IT | Clinical IT & diagnostics informatics | Top healthcare technology supplier. |

| IBM (Watson Health) | ~$16 B technology revenue (Watson divested but legacy tech remains) | AI & analytics healthcare IT | Known for analytics and AI in clinical decision support. |

| InterSystems | Not publicly disclosed revenue | Healthcare data sharing (FHIR, HL7) | Key interoperability solutions provider. |

| Health Catalyst | Not publicly posted revenue | Data analytics & outcomes improvement | Strong data platform presence. |

| CareCloud | Private; revenues undisclosed | EHR + practice + RCM | Integrated practice IT systems. |

Strategic Healthcare IT Investments: Key Focus Areas

Healthcare organizations are focusing on various technologies to improve care, streamline operations, and meet the growing demand for digital solutions. Below are the main areas driving investment:

1. AI & Automation in Healthcare

AI solutions are being widely adopted to automate clinical documentation, support decision-making, and enhance predictive analytics.

Strategic Focus:

- Clinical Documentation Automation: Reduces clinician workload and administrative burdens.

- Predictive Analytics: Anticipates patient risks, supports early intervention, and improves patient outcomes.

-

Diagnostic Decision Support: AI aids in clinical decision-making, enhancing diagnostic accuracy.

2. Healthcare Data Infrastructure

Investments in EHR systems, cloud migration, and data interoperability are essential to improving data sharing and patient care coordination.

Strategic Focus:

- EHR Upgrades: Ensuring seamless, updated patient records across healthcare systems.

- Data Interoperability: Enhancing data sharing and access across different healthcare providers.

-

Shared Data Platforms: Platforms like Truveta allow for the integration of health system data, enabling more effective decision-making and research.

3. Telehealth & Virtual Care

Telehealth services have surged in popularity, especially following the pandemic. Investments in telemedicine infrastructure improve access to care, particularly for underserved populations.

Strategic Focus:

- Remote Monitoring: Helps manage chronic conditions without requiring in-person visits.

- Virtual Care Platforms: Enable patients to receive consultations and treatments remotely, reducing operational costs and enhancing care access.

4. Analytics & Decision Support

Healthcare analytics platforms transform data into actionable insights, improving population health management and quality care metrics.

Strategic Focus:

- Population Health Insights: Data platforms help identify at-risk populations, improve preventive care.

- Quality Improvement Metrics: Healthcare systems use analytics to track performance and ensure high-quality care.

-

Value-Based Care: Analytics drive value-based payment models that focus on patient outcomes rather than service volume.

Healthcare IT Segment Spend (Global)

The total market for healthcare IT systems has expanded rapidly, with key areas of spend reflecting the priorities of healthcare providers. Below is the breakdown of global healthcare IT spending:

| Year | EHR & Clinical IT | Telehealth | Analytics & AI | Total Spend (USD Bn) |

| 2020 | 120 | 30 | 20 | ~170 |

| 2021 | 140 | 36 | 24 | ~200 |

| 2022 | 160 | 42 | 29 | ~231 |

| 2023 | 180 | 50 | 35 | ~265 |

| 2024 | 210 | 60 | 42 | ~312 |

| 2025 | 240 | 72 | 56 | ~368 |

| 2026 | 276 | 86 | 73 | ~435 |

| 2027 | 317 | 104 | 95 | ~516 |

| 2028 | 364 | 125 | 124 | ~613 |

| 2029 | 418 | 150 | 161 | ~729 |

Key Insights:

- EHR & Clinical IT continues to dominate healthcare IT spend, although Telehealth and Analytics & AI are growing rapidly, especially in the post-pandemic era.

- Telehealth and AI platforms are projected to see the fastest growth in the coming years as digital healthcare adoption deepens.

Healthcare IT Implementation & Pricing

Here’s a look at the development and implementation costs for various healthcare IT platforms:

| Year | EHR Implementation | Telehealth Platform | Analytics & AI Platform |

| 2020 | $2.0M–$4.0M | $0.4M–$1.2M | $0.5M–$1.5M |

| 2021 | $2.1M–$4.2M | $0.42M–$1.26M | $0.53M–$1.58M |

| 2022 | $2.2M–$4.4M | $0.44M–$1.32M | $0.56M–$1.62M |

| 2023 | $2.4M–$4.7M | $0.48M–$1.4M | $0.6M–$1.7M |

| 2024 | $2.6M–$5.1M | $0.52M–$1.48M | $0.64M–$1.78M |

Key Insights:

- EHR systems have the highest initial implementation costs, reflecting their complexity and critical role in healthcare operations.

- Telehealth platforms have lower initial costs but scale with users, making them accessible for a broad range of healthcare organizations.

-

Analytics & AI platforms vary in cost depending on the scope of services, with complex systems driving higher prices.

Price Interpretation and Buyer Spend

Here’s a breakdown of the subscription/license and service prices that healthcare providers typically pay for IT solutions:

| Year | EHR Subscription/License | Telehealth Services | Analytics & AI Services |

| 2020 | $0.8M–$6.0M | $0.2M–$1.5M | $0.3M–$2.0M |

| 2021 | $0.85M–$6.4M | $0.22M–$1.58M | $0.32M–$2.1M |

| 2022 | $0.9M–$6.8M | $0.24M–$1.68M | $0.35M–$2.2M |

| 2023 | $0.95M–$7.2M | $0.26M–$1.8M | $0.38M–$2.35M |

| 2024 | $1.0M–$7.7M | $0.28M–$1.92M | $0.42M–$2.5M |

Key Insights:

- EHR subscription and license fees remain the most significant cost for healthcare providers.

- Telehealth services have lower initial costs but grow with the increase in users and the services offered.

-

Analytics/AI services have higher associated costs due to consulting, platform usage, and ongoing service fees.

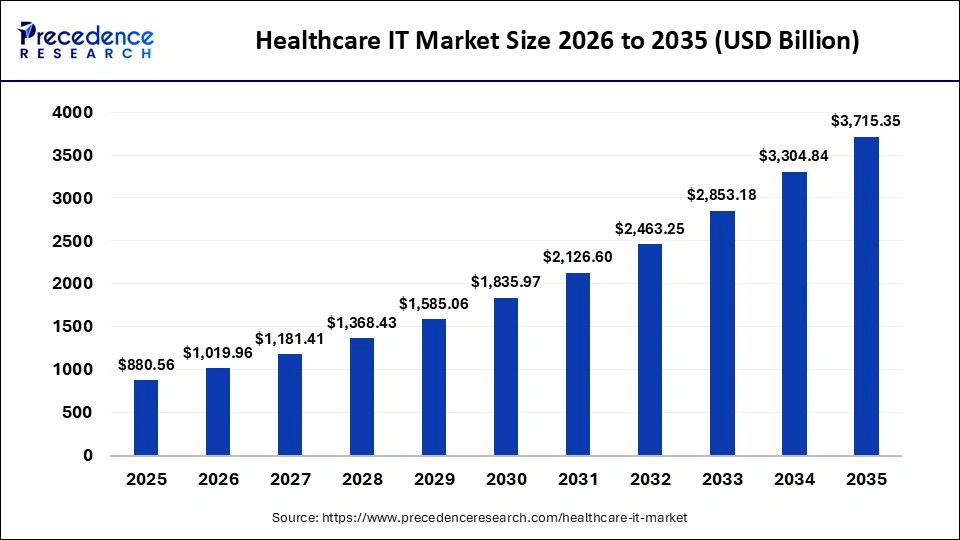

What is the Healthcare IT Market Size?

The global healthcare IT market size accounted for USD 880.56 billion in 2025 and is predicted to be worth around USD 3,715.34 billion by 2035, growing at a CAGR of 15.48% from 2026 to 2035.

The Future of Healthcare IT Investments

The healthcare IT sector continues to see significant investment, particularly in the areas of AI, telehealth, and data infrastructure. With the increasing adoption of EHRs and telehealth platforms, healthcare organizations are modernizing their systems to improve care delivery, operational efficiency, and patient outcomes. As spending in these areas grows, the focus on AI and predictive analytics will drive further transformation, making healthcare services more accessible and personalized for patients around the world.

Request Research Report Built Around Your Goals: sales@precedenceresearch.com

About Us: Precedence Research

Our Legacy: Rooted in Research, Focused on the Future

Looking for research that drives real results? Precedence Research delivers strategic, actionable insights, not just data and charts. Based in Canada and India, our team specializes in customized market analysis, executive-level consulting, and tailored research solutions that go beyond traditional survey methodologies to support business growth with precision and confidence.

Insight-Driven

We turn complex data into clear, strategic insights that power confident business decisions.

Innovation-Led

We continuously refine our methods to stay ahead of trends and emerging market forces.

Industry-Agnostic

From tech to healthcare, we serve clients across sectors with tailored, actionable intelligence.

Customer-Centric, Future-Focused, Result-Oriented

We work as strategic partners, engaging deeply with clients to co-create impactful solutions.

Our Commitment: Delivering Intelligence That Drives Transformational Growth

What do we do? We turn data noise into clarity. Through sharp research, agile thinking, and tech-enabled tools, we fuel brands, disrupt markets, and lead with insight that drives unstoppable growth.

Contact Us

USA: +1 8044 419344

APAC: +61 4859 81310 or +91 87933 22019 or +6531051271

Europe: +44 7383 092 044

Email: sales@precedenceresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.